a loan is not what it seem

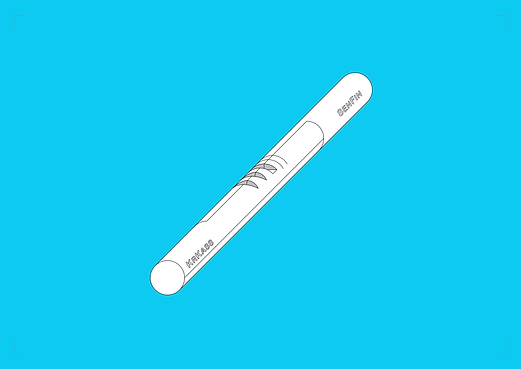

TALLY STICKS

XXL

GINIBANK &

a loan is not what it seems

Background

The Tally Sticks XXL project draws reference to the device used in the 19th century to carve the debt amounts of business partners, private individuals, or public authorities into a split piece of wood, thus creating a kind of balance sheet for both sides.

How much is something?

10 bln. EUR

1 bln. EUR

100 mil. EUR

10 mil. EUR

It is remarkable that, today, we generally know how much a city, a municipality, or a country are in debt, but their creditors are not named as a rule. Negative assets are mostly assignable, while high asset amounts remain anonymous. While the 14 creditor categories are named on the tally sticks, they do not tell us which individual creditor is owed how much.

The Tally Sticks XXL project explores this debt relationship, and the tally sticks refer to the debt relationship today between Berlin and its 14 creditors.

These categories still reveal nothing specific about the creditors, who unfortunately mostly remain anonymous.

Please help us if you know more about Berlin’s various creditors.

Write us an email to:

kerbhoelzer-xxl@mailbox.org or leave a message on this website.

Fault & Believe

The creditor was given one piece of the wood, while the other piece went to the debtor. The notches were identical on both parts, and when the two pieces were joined together again, the fact that both notches and the grain of the wood matched showed that the information shown on the tally sticks was genuine. It was forgery-proof.

14 categories

1 mil. EUR

AUSLBK

1

Foreign banks

Berlins debts with foreign banks

Branches of foreign banks in Germany.

You can find a list of foreign banks represented in Germany here:

BK SOAUFG

2

Banks for Special Purposes

Berlin’s debts with banks for special purposes

Banks that were founded for a special purpose, to promote a region or a circle of people.

Examples are the Kreditanstalt für Wiederaufbau (KFW) or the Landwirtschaftliche Rentenbank

BSPKASS

3

Building Societies

Berlin’s debts with building societies

Credit institutes that are supposed to promote the collective saving and financing of real estate or residential properties.

GENBK

4

Credit Cooperatives

Berlin’s debts with credit cooperatives

These banks are supposed to act in the interests of their members. Their purpose is to support the economic, social ,and cultural interests of the cooperative. Their target group is generally made up of small- and medium-sized businesses. They see themselves as “values-oriented” banks (e.g., Raiffeisenbank, GLS Bank, etc.)

HYPBK

5

Mortgage banks

Berlin’s debts with mortgage banks

These banks work in the area of property financing.

Money is classically borrowed here using plots of land or real estate as security. They give loans, public-sector loans, or official loans.

KRKASS

6

Health Insurers

Berlin’s debts with health insurers

Health insurance companies assume the costs for insured parties (pro rata) in the event of illness or medical care.

LDBK

7

Regional Banks

Berlin’s debts with regional banks

Regional or local government funding agencies in the respective federal states. These carry out financial transactions, among other things, for the federal states (the Länder). The Landesbank Berlin now belongs completely to the Sparkassen Financial Group.

PRIVGSCHBK

8

Private Business Banks

Berlins Schulden bei privaten Geschäftsbanken

Unlike cooperative banks or trustee savings banks, private business banks are profit-oriented and centrally organized commercial groups or stock corporations (e.g., Commerzbank, Deutsche Bank etc.).

SPARKASS

9

Trustee Savings Banks

Berlin’s debts with trustee savings banks

Credit institutes that are supposed to promote saving and the formation of wealth and are often held by public bodies. They are directed at the “processing of cashless payment transactions”.

VERSGES

10

Insurance Companies

Berlin’s debts with insurance companies

Insurance companies that are organized in corporations.

VERSORKL

11

Civil Servant Pension Funds

Berlin’s debts with civil servant pension funds

Reserves that are used to secure the payment of pensions to retired higher civil servants (Beamte). These special assets may, for example, be invested in debt securities of the federal states (the Länder) or the central government (the Bund).

ZUSVERSOEINR

12

Supplementary Pensions Institution

Berlin’s debts with supplementary pensions institutions

Company pension schemes for community and civil service. There are 30 supplementary pensions institutions for employees of the civil service.

ANLEUR

13

Investments in euros

Berlin’s debts with investments in euros

Money borrowed by Berlin as loans in euros.

ANL FRW

14

Investments in foreign currencies

Berlin’s debts with investments in foreign currencies

Money borrowed by Berlin as loans in foreign currency.

GINIBANK

The Gini Coefficient

Visitors can sit on the Gini bench. It is situated right next to the tally sticks. The bench itself has a grid, the numbers 0 and 1, and a curve carved into it. These figures refer to the Gini wealth coefficient. In Germany, this coefficient is 0.81, and this figure is also noted in the bench.

The Ginibank

The extent of inequality in a society can be shown using the Gini coefficient. If everyone has the same amount of wealth, the Gini coefficient is equal to 0. If all wealth belongs to one person and nothing is left for everyone else, the Gini coefficient is equal to 1. In the Federal Republic of Germany, the Gini coefficient in 2020 – i.e., before the corona situation – was 0.81-0.83. If you compare this figure with the Gini coefficient in the USA, you will notice that there is hardly any difference. There it is 0.85 to 0.87. This means we have experienced an Americanization of our wealth structure in Germany, as C. Butterwegge – who researches into wealth and poverty – puts it. This extreme inequality leads to polarization in society and to a drifting apart of different social groups.

Wealth

We are only 0.19 to 0.17 percentage points away from total wealth being in one hand. Today, the top 0.001% of the population owns more than 20% of total wealth. The richest 10% have more than 67% net wealth. How can democratic co-determination be reconciled with the maximum concentration of wealth?

How can a state or a city still provide social services and make citizen participation possible if the state or the city first has to borrow the money to pay for these services? And is money not a public good that is largely made available to us by the central banks? So why does the public sector have to borrow money from mostly private actors on the capital market?